An increasing number of the nation’s auto insurance companies have a new proposition: Let them track every second of your driving in exchange for an annual discount that can reach into the hundreds of dollars if you behave yourself on the road.

In theory, everyone wins here. Progressive, Allstate and State Farm — among the most aggressive of the larger companies that are pursuing this strategy — attract better drivers who crash less often. Customers who sign up for the optional programs can pay premiums based more on how they drive and less on their age, gender or credit history.

But usage-based insurance, as the program is known, generates vast amounts of data. While insurance companies are pledging to keep it to themselves for now, some experts believe that we’re only a few years away from companies’ contributing complete driver histories into a central industry database. Then, we’d all have driver scores like the numbers that FICO helps creditors calculate, which would follow us around whenever we shopped for a new auto insurance policy.

Photo

How quickly that day comes will depend on how many people allow insurance companies to ride shotgun in the near future, since they can’t create scores unless they can persuade us to share our driving data. To see how it felt, my wife and I let State Farm keep an eye on us this summer.

State Farm sent us a device that we plugged into a port under the steering wheel of our 2003 Toyota Highlander. That was all we had to do to begin; the machine wirelessly transmitted data about our movements to the company.

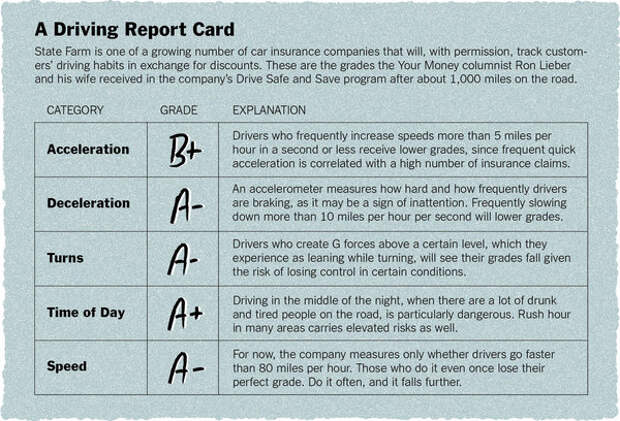

A few weeks later, we started getting feedback in the form of a report card that State Farm issues to customers participating in its Drive Safe and Save program. The company assesses drivers in five categories — acceleration, deceleration, turns, time of day and speed — with grades ranging from A to C. (The company didn’t want to hurt anyone’s feelings by flunking them.) The grades are then plugged into a formula that determines discounts.

For now, the company’s interest in a customer’s speed extends only to whether you’re driving more than 80 miles per hour, and if so, for how long. We did just a bit while in a 65 m.p.h. zone on the Massachusetts Turnpike and ended up with an A-minus grade in that category. Our lead foot on the accelerator led to our worst grade, a B-plus, in the acceleration category. The company has data showing correlations between higher claims and repeated instances of increasing speed more than 5 m.p.h. in less than a second. Our A-minus on deceleration meant that we didn’t slow down by more than 10 m.p.h. in less than a second too often, an indication that we weren’t slamming on the brakes much and were probably paying decent attention to the road.

Our A-minus on turns was a pleasant surprise given the number of curves we encountered while driving on vacation, but the device can measure the G forces exerted from each turn and we mostly passed muster there. Our only perfect grade was in the time-of-day category, as we didn’t drive during rush hour and we stay off the roads from midnight to 4 a.m. when the drunk and exhausted are out in force.

For our above-average efforts, State Farm said we would have qualified for a 22 percent annual discount on a policy with generous coverage limits in New Jersey if we drove about 10,000 miles a year, reflecting a $190 discount off an initial $870 premium.

Over all, participants in the program get an average of 10 to 15 percent off their premium, and everyone gets at least something for playing along. At Progressive’s Snapshot program, people who do qualify for the discount tend to save an average of 10 to 15 percent. Some other companies require you to keep the in-vehicle device for continuous monitoring (and possible price adjustments later) and may make you pay a fee for it plus some ancillary services; others ask you to send it back after six months but allow for a retest later upon request.

At the moment, State Farm and Progressive are not raising rates on people who sign up for monitoring and prove to be terrible drivers. Participation is voluntary, and Progressive, the early adopter in usage-based insurance, says that close to 15 percent of its customers are already enrolled.

Still, as more people sign up, the standard rate will start to feel like a penalty for those who decline to participate. And if all of the good drivers pile into the programs and qualify for lower prices, the companies may eventually raise rates on the holdouts. One bonus for parents who are on the fence: You can often use an insurer’s usage-based insurance or related tracking programs to monitor your teenager’s driving. And Safeco Insurance has an interesting twist, in which people who have gotten speeding tickets or been in accidents can use a monitoring device to requalify for the rate they had before the black mark went on their records.

Given all these incentives, why might someone hold out?

First, not every company offers a usage-based insurance policy. Our insurance company, USAA, does not, although it has started a pilot programto gather data. Geico has no program either, and a spokeswoman declined to comment on the reason. Progressive, State Farm, Allstate and others have policies or pilot programs, but people in certain states or who drive vehicles that are incompatible with the companies’ hardware may not be able to sign up or may not be able to share as much driving data.

But privacy is the biggest concern. While the major players are not yet tracking exact latitude or longitude, they would like to, and Progressive is testing it. “A mile driven on a highway is safer than a mile on a city street with lots of intersections, but in today’s world we don’t know which road you’re on,” said Dave Pratt, general manager of usage-based insurance at Progressive. Some customers are already asking for the company to track them in this way.

The companies probably have little interest in who you’re visiting or patronizing on any given day, but divorce lawyers and others may one day subpoena the information if insurance companies store it. The data can work in drivers’ favor too, though; one Progressive customer used his driving datato prove that he did not kill his infant daughter, who died of asphyxiation at her home. The company can also pull the data if you think it might help you avoid fault when you’re making a claim; so far, it is not doing this unless customers ask it to, though it’s hard to imagine that insurance companies won’t eventually be grabbing for the information while examining future claims.

For those of us with no privacy concerns, it’s difficult to make a solid case against usage-based insurance. For me, it turned driving into a game that could yield real money through safer behavior. Progressive’s data already shows that people learn to brake more gently within weeks of signing up; unlike with State Farm, Progressive’s device beeps when you’re slowing down too fast. The companies are betting that by giving safer drivers better deals, they will retain them longer and make up for the discounts with fewer claims over time. Plus, the front-runners in the industry will undoubtedly attract good drivers from competitors that don’t offer the discounts, leaving the laggards with potentially higher costs from those who remain.

The one lingering worry is that possibility of a FICO-like driver score. The leading companies in usage-based insurance say they want nothing of the sort. After all, they have more data than their competitors, so why would they share it?

Unsurprisingly, the companies that could benefit from universal driver scores by helping insurers collect the data believe such a score is inevitable. “I don’t see how it doesn’t happen,” said David Lukens, director of vertical markets at LexisNexis Risk Solutions, which already helps auto insurers generate scores internally, ranging from 200 to 997. “There will be a tipping point where if most companies have this data, they’re going to weigh the costs and benefits of sharing it.”

While insurers currently promise to keep customer data to themselves, they could end that agreement starting on a certain date. In fact, it may be customers who ask them to do so when they inevitably go from feeling grateful for the discounts to feeling captive because no other company knows what a great driver they are. “People are going to want to say that the driving data is mine, and I want the ability to shop that around in the same way that they do with credit data,” said Brian Sullivan, editor of the Auto Insurance Report.

Which is fine, as long as the data is correct. It won’t be, because no system is perfect, though one hopes it will not be as error-strewn as credit reports are today. But that’s a concern for the future. For now, anyone with little to hide and a desire to drive better can help themselves to some free money while the insurance companies fight over the more careful drivers among us.